4.2 Corporate Governance Practices

The Corporate Governance Code [41] interprets corporate governance as a notion embracing relationships between executive bodies of a joint-stock company, its Board of Directors, shareholders and other stakeholders. Corporate governance is a tool for identifying firm’s goals and ways to achieve these goals as well as for fostering efficient oversight of firm’s operations for shareholders and other stakeholders.

Core goals of corporate governance are:

i) crafting of an effective system for protection and efficient disposal of shareholder’s resources;

ii) reduction of risks which investors are unable to evaluate and unwilling to accept and management of which by investors in the long run shall inevitably result in reduction of firm’s investment prospects and share prices.

Our corporate governance practices are premised on the principles, described below:

Accountability of the Company’s Board of Directors to all stockholders is statutory and serves as guidance for the Board of Directors in formulating the strategy and administering executive bodies of the Company.

The Company is voluntarily committed to protecting stockholder rights and enforcing equal treatment of all stockholders. The Board of Directors provides all stockholders with an opportunity of viable defense if their rights are disregarded.

The Company enforces just-in-time disclosure of reliable information regarding all corporate events or actions, including but not limited to its financial position, performance, ownership structure and management, and oversees that any stakeholder has an unhindered access to such information.

The Company recognizes its liability to all stockholders of the Company.

Its corporate governance practices constantly upgraded, the Company keeps its fingers on the pulse of corporate governance trends evolving in Russia. The Company highlights the importance of the Corporate Governance Code, adopted and enforced by the Central Bank since 2014. Principles and recommendations of the Code set the bar high and serve as a guidemark for further development of the corporate governance system by the Company. We also focus hard on regulatory requirements to reflect them in our corporate governance practices.

The corporate governance system of PAOPublic Joint-Stock Company Rosseti Ural is based on principles designed to multiply assets, enhance investment prospects and market value, maintain the Company’s financial stability and profitability as well as respect the rights and interests of stockholders and stakeholders.

Please, visit our official website to examine bylaws regulating corporate governance principles, practices and procedures.

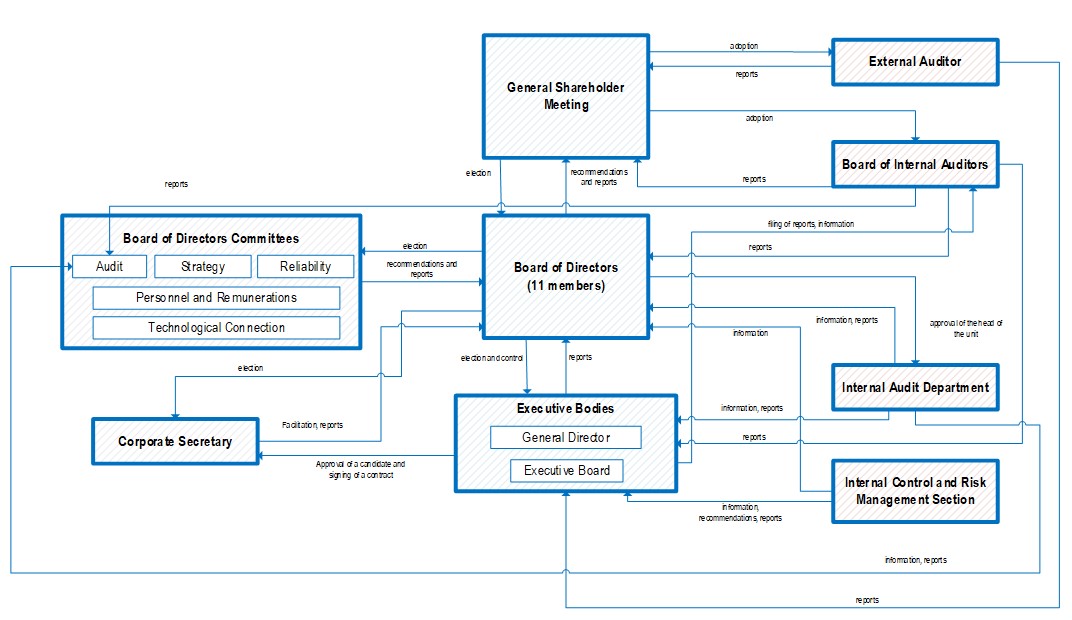

Corporate governance structure

Self-evaluation of corporate governance level

The Company conducts self-evaluation of corporate governance practices on an annual basis in compliance with the Methodology [42].

CY2022-2023 evaluation of efficiency of corporate governance*

| Component | Number of criteria under evaluation | Largest possible score | Internal Audit’s evaluation | Compliance, % | Evaluation of corporate governance |

|---|---|---|---|---|---|

| Shareholder rights | 19 | 71 | 65 | 92% | Developed practices |

| Board of Directors | 51 | 185 | 120 | 65% | Good practices |

| Executive bodies | 5 | 40 | 34 | 85% | Developed practices |

| Transparency and disclosures | 15 | 135 | 113 | 84% | Developed practices |

| Risk management, internal control and internal audit | 16 | 63 | 63 | 100% | Best practices |

| Corporate social responsibility, business ethics | 6 | 31 | 31 | 100% | Best practices |

| Total score: | 112 | 525 | 426 | 81% | Developed practices |

Compliance with the principles of the Corporate Governance Code**

| Aspects | Principles, recommended by the Code | Principles complied with in full | Principles complied with in part | Principles that are not complied with by the Company |

|---|---|---|---|---|

| Rights of stockholders and equal treatment of stockholders in the exercising of their rights | 13 | 12 | 0 | 1 |

| Board of Directors | 36 | 26 | 8 | 2 |

| Corporate Secretary | 2 | 2 | 0 | 0 |

| Remuneration system | 10 | 8 | 2 | 0 |

| Risk Management and Internal Control System | 6 | 6 | 0 | 0 |

| Information disclosure, information policy | 7 | 6 | 1 | 0 |

| Significant and important corporate actions and events | 5 | 3 | 2 | 0 |

| Total | 79 | 63 | 13 | 3 |

Examine the Appendix for more details on the Company’s compliance with the principles and recommendations of the Corporate Governance Code.